NCIF's Social Performance Metrics

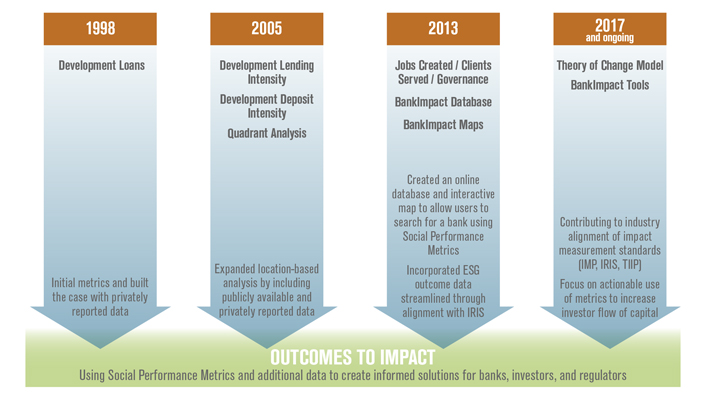

The idea for bank-specific impact metrics grew from conversations with leading CDFI Bank executives, who recognized a strategic need to communicate the importance of their work. Since initial conversations, we’ve grown our metrics to capture a greater range of banks’ impacts, developed peer group and time series analysis and expanded the products we use to share the metrics.

The social performance metrics began with publicly-available data from the FDIC, FFIEC, US Census, and HMDA lending database. Over time, as both investors and banks began applying social performance metrics in their assessments, the metrics were expanded to include privately-reported data. Reporting banks give rich detail about jobs created, staff and board diversity, and lending, which NCIF geo-codes and quantifies. Banks also provide qualitative information expressing the special needs of their communities and the tailored programs they’ve crafted to meet those needs. Mission Intensity, the most recent addition to the metrics, quantifies the portion of a bank’s lending which supports its mission.

Use of the metrics continues to grow, making SPM the standard for the mission-oriented financial industry. NCIF strives to promote a standardized taxonomy of industry metrics by partnering with global institutions in the impact investing field, such as the Global Impact Investing Network (the GIIN). SPM is fully aligned with the GIIN’s IRIS initiative of standardized impact metrics. NCIF strives to reduce the cost of reporting by developing a web-based reporting infrastructure and using streamlined metrics.

See below for more on the evolution of the social performance metrics:

Under development:

- New metrics as well as new BankImpact measurement tools