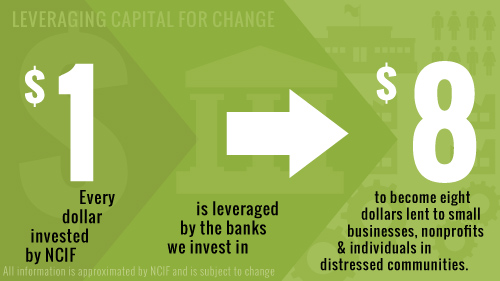

NCIF supports mission-oriented banks by opening strategic certificates of deposit. These stable, core deposits help banks manage liquidity and increase capital available for lending.

NCIF Deposits Initiative

NCIF has been successful in helping socially responsible investors place large-scale deposits in mission-oriented banks. TIAA-CREF, the W. K. Kellogg Foundation, and others have placed over $70 million in new deposits into the CDFI Banking industry using NCIF's Social Performance Metrics to inform their selections. With these deposits, banks can increase their high-impact activities in low-income communities.

Get Involved

Is your mission-oriented bank seeking deposits? Contact us to connect with investors.

Are you an impact investor? Find and compare banks using NCIF's BankImpact resources. Read our Deposits Initiative publication with an overview of investment products available through banks.

NCIF Impact

NCIF’s deposits improve the stability of mission-oriented financial institutions like the ones listed below.

NCIF Deposits Portfolio

Below is a cumulative list of banks in NCIF’s deposit portfolio.

|

American Metro Bank Chicago, IL – CDFI, MDI DLI-HMDA: 59.13% DDI: 100.00% |

Legacy Bank Acquired by Seaway Bank and Trust

|

|

Bank2 Oklahoma City, OK – CDFI, MDI DLI-HMDA: 29.12% DDI: 100.00%

|

Lower East Side People's Federal Credit Union New York, NY – CDFI |

|

Broadway Federal Bank FSB Los Angeles, CA – CDFI, MDI DLI-HMDA: 87.38% DDI: 66.67%

|

Liberty Bank and Trust Company New Orleans, LA – CDFI, MDI DLI-HMDA: 56.13% DDI: 94.12%

|

|

Citizens Savings Bank & Trust Nashville, TN – CDFI, MDI DLI-HMDA: 60.19% DDI: 100.00%

|

Millennia Community Bank Acquired by TrustAtlantic Financial Corp. Raleigh, NC

|

|

Community Bank of Florida Acquired by CenterState Bank of Florida Homestead, FL

|

Neighborhood National Bank San Diego, CA – CDFI DLI-HMDA: 88.20% DDI: 66.67%

|

|

Community Bank of the Bay Oakland, CA – CDFI DLI-HMDA: 53.73% DDI: 50.00%

|

New Resource Bank National City, CA DLI-HMDA: N/A DDI: 0.00% |

|

Continental National Bank Miami, FL – MDI DLI-HMDA: 66.75% DDI: 85.71%

|

Opportunities Credit Union Winooski, VT

|

|

First American International Bank New York, NY – CDFI, MDI DLI-HMDA: 59.45% DDI: 88.89%

|

ProAmerica Bank Acquired by Pan American Bank Los Angeles, CA – CDFI, MDI |

|

First Choice Bank Cerritos , CA – CDFI, MDI DLI-HMDA: 14.32% DDI: 88.89%

|

Security Federal Bank Aiken, SC – CDFI DLI-HMDA: 41.96% DDI: 61.54% |

|

Harbor Bank of Maryland Baltimore , MD – CDFI, MDI DLI-HMDA: 52.38% DDI: 85.71%

|

Spring Bank Bronx, NY – CDFI DLI-HMDA: 100.00% DDI: 100.00%

|

|

Industrial Bank Washington, DC – CDFI, MDI DLI-HMDA: 68.62% DDI: 100.00%

|

Syracuse Cooperative Credit Union Syracuse, NY |

|

International Bank of Chicago Chicago, IL – CDFI, MDI DLI-HMDA: 54.09% DDI: 57.14%

|

Unity National Bank of Houston Houston, TX – MDI DLI-HMDA: 53.32% DDI: 50.00% |

|

Latino Community Credit Union Durham, NC – CDFI |

Urban Partnership Bank Chicago, IL – CDFI, MDI DLI-HMDA: 91.75% DDI: 90.00% |

NCIF Social Performance Metrics:

DDI: % of a bank’s branches located in low- and moderate-income communities.

DLI-HMDA: % a bank’s HMDA-reported lending occurring in low- and moderate-income areas.

Complete definitions.

All information is based on annual HMDA data (ffiec.gov), Census data, annual Summary of Deposits data (fdic.gov), and Statistics on Depository Institutions (fdic.gov) as well as private reporting from banks where appropriate. DLI-HMDA and DDI data is based on data released on 12/31/2018. Financial data is as of 12/31/2019.