NCIF pioneered impact measurement specifically for the mission-oriented banking industry in order to strengthen banks and attract investors. As an impact investor, NCIF seeks social as well as financial returns from our investments and urges other investors to do the same. NCIF developed clear, compelling, broadly accepted Social Performance Metrics (SPM) for mission-oriented banks with the following objectives:

- Inform investors about the social impact their investments are generating

- Help bank management evaluate a bank’s progress toward achieving its mission objectives

- Demonstrate the importance of the industry to regulators and legislators

- Show consumers the effect that mission-oriented banks have in their community

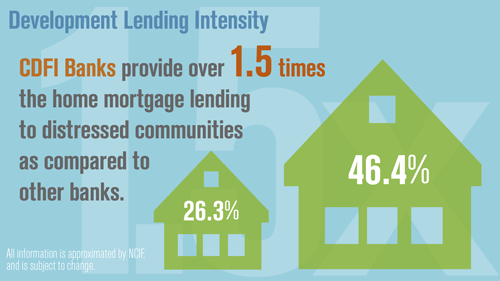

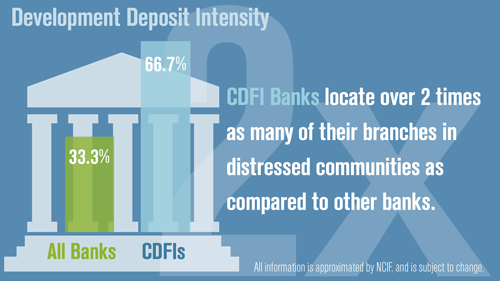

Quantitative data includes objective indices of social impact, geocoded and calculated by NCIF as the Development Lending Intensity (DLI) and Development Deposit Intensity (DDI), among other metrics.

Qualitative data captures the anecdotal and individual characteristics behind each institution’s mission within its community.

NCIF strives to promote a standardized taxonomy of industry metrics by partnering with global institutions in the impact investing field, such as the Global Impact Investing Network (the GIIN). SPM is fully aligned with the GIIN’s IRIS initiative of standardized impact metrics.

SPM is aggregated and analyzed in NCIF’s Publications and Research, including the BankImpact Dashboards, our annual publication of bank profiles and impact data.